Learn from Your Mistakes or Top 10 Rookie Mistakes to Avoid When Diving Into the Crypto World

In our world, there are numerous types of blockchain networks. If you assume that you will conduct an exchange on the blockchain, you should be aware that your trade will be irrevocable and that a simple error caused by a human failure could result in a significant loss. All things considered, all exchange records are kept in blocks, linked to form a long chain, followed by statistical algorithms, and further secured to safeguard information. In this method, changing the transaction would be extremely difficult and involve a lot of digital processes. This informative article looks at the most well-known crypto mistakes and offers suggestions on how to avoid committing them again. We can view innumerable research online, but consumers continue to make mistakes and lose enormous sums of funds.

10 Most Common Crypto Mistakes

Incorrect Choice of Crypto Platform

You should definitely choose a cryptographic money exchange to connect with before you start exchanging. Some of the key factors to consider when choosing the best trade for your particular needs are the platform’s ease and usability, the variety of available digital currencies, the low interest and affordable resource costs, the strong credibility and confidentiality of the platform, and the responsive and customised client service.

Customer service can point you in the right direction and help you wait to be a very knowledgeable and successful trader at every turn. In a good crypto platform like https://bitcoin-loophole.io, they offer a broker connection where investors can fully grasp the concept of cryptoverse. Some cryptocurrency platforms are difficult to use, which can be extremely unpleasant if you’re still learning everything.

Not Mindful of Frauds/Scams

On the internet, there are innumerable swindlers. Greed occasionally results in unwanted despair. Scammers continue to present enticing investment schemes that offer better returns, but in actuality, they simply devour your funds and leave you with nothing.

Don’t ever hand over crypto to strangers hoping for great returns. Never open malicious links that are sent to you by text or email, and never visit unreliable sites. Never keep passwords anywhere, and never leave necessary information on your pc without ensuring encryption keys.

Engaging in the Wrong Crypto

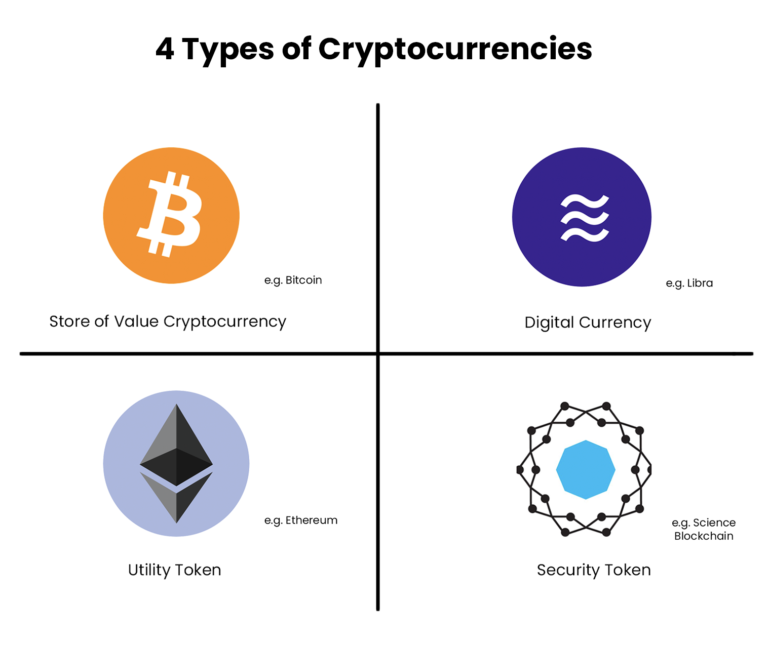

Not all digital currencies are certified and useful for investing in the digital money markets. Scammers have created so many nonsense money forms that they advertise the coin or token on fraudulent trades and start to control the costs of crypto to lure you into the pit. Even knowledgeable traders occasionally fall victim to these scams due to their insatiability. Please DYOR before investing in any digital currency. You should be aware of the risks because you are aware of how unpredictable the cryptocurrency market is. Before purchasing coins, look into the specifics of the project.

Storing in a Single Wallet

Unfortunate incidents occasionally cause you to lose the encryption data to your wallet. There are innumerable examples of people carrying cryptocurrency worth many thousands of dollars in their wallets. A few customers have misplaced the private keys they used to save their digital currency. Therefore, to be safe, spread your asset allocation by holding the resources in separate reputable wallets to avoid the chance that you’ll lose all of your cryptocurrency.

Focusing Too Much on Altcoins

The truth is that small market valuation coins can surely experience massive gains, but the price can fall just as quickly as it rises. Maintaining control over your portfolio is important. Gains may temporarily be cleaned out of a portfolio if it invests too aggressively in altcoins. Fencing it with some top-tier digital currencies like Bitcoin and Ethereum is an efficient way to reduce value instability.

FOMO Kicks In

One of the main factors contributing to newcomers losing money in their trading careers from the start is a fear of missing out. FOMO is the fear of missing out on a limited chance, and all of the advantages that go along with it. While totally going to get rid of FOMO is difficult, you can help counter it by encouraging an exchange process and setting regulations that include limitations on the permitted gains and losses for each currency you engage in. Take it easy and forget about your FOMO. Adhering to your plan while the market is swinging crazily is a technique that will work well for you in the long term.

Unaware of When to Stake and Leave

Even if every newbie trader longs for the current situation, many are unsure of what to do when it really transpires. They frequently end up keeping a resource for too long. Then it all crumbles, taking its advantages with it. You expose yourself to a great deal of risks if you don’t know what your objectives and deadlines are for a transaction. Have rather specific goals and threshold points for the amount you want to make as well as the times when you will pick up, move on, and exit before buying a coin. Developing the ability to control your impulses and maintain your composure under pressure and when a lot is at risk is a crucial component of becoming a good investor.

Panic Trading

In the cryptoverse, price fluctuations are the usual instead of an exception. When prices decline, many novices tend to overreact. They frequently overcheck their accounts and then offer to abandon everything that may already be hopeless. Something important to keep in mind is that when you sell, you can lose an exchange. Of course, there are occasions when selling when things begin to go downhill might save you a substantial amount of money, but understanding how to deal with price swings while maintaining focus on your breaking points and objectives will be extremely helpful to you in the long run.

Lack of Diversification

Since it is unlikely that all digital forms of money will collapse at once, doing this is much more viable than investing in just one currency. You can create a method that is specific to your aims, risk profile, and exchanging style.

Overall, it is advised to balance some of the biggest, most stable cryptocurrencies with some moderate to small cryptocurrencies in terms of market capitalisation. If you are new to crypto, a wise guideline to adhere to is an 80:20 mix of large to mid to small cap. This will also help your portfolio’s stability problems be kept to a minimum.

Influencer Marketing

Several personalities have accumulated such a significant group following that initiatives would gladly pay big bucks to have them advance their projects. Financial investors must take care to avoid making such initiatives appear to be the greatest option ever while also concealing the fact that it is a sponsored ad. Since only you are liable for your own investment, it is best to DYOR rather than aimlessly following the influencers.

Conclusion

This list of most common crypto mistakes to avoid just names a few; hopefully, it was beneficial. Look at trading platforms like Bitcoin Up, which gives investors a secure and straightforward way to profit from cryptocurrencies. If you are a novice to the world of digital currencies and are seeking a crypto platform with cheap costs, customised client service, and a convenient interface. It also offers a ton of other crypto content for newbies who are looking to learn the relevant information they need to make sensible, good profits at every move.

Read More: Tips to Get the most out of your Billboard Advertising Campaign